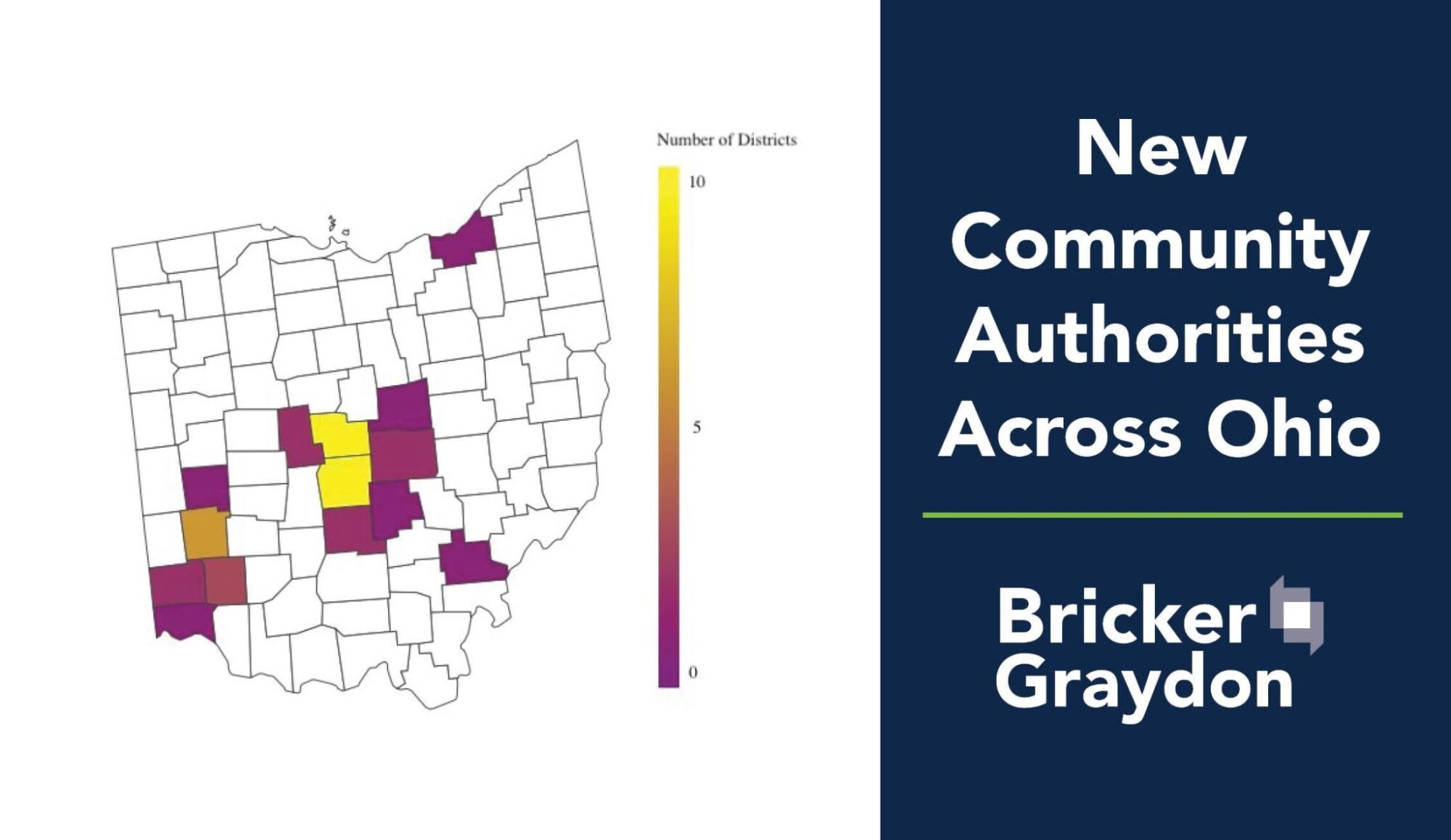

Local governments across Ohio are engaged in a competitive race to spur economic development, attract developers, and secure long-term prosperity. And while most local governments are familiar with traditional economic development tools—Bricker Graydon LLP mapping of active New Community Authority (NCA) usage across Ohio’s 88 counties indicates that most local governments are not yet familiar with the NCA program.

In a competitive economic development environment, additional tools exist that many communities could add to their economic development toolkits. Ohio’s NCA program is one of them.

What is an NCA?

In short, it’s a living entity.

An NCA is a political subdivision created under state law and governed by a Board of Directors, which may levy “community development charges” to finance “community facilities” within its territory (think public infrastructure +). At its heart, NCA is a voluntary program allowing property owners to request the addition of their property to the territory of the NCA—all to unlock new financing streams necessary to move individual projects forward or contribute to long-term community capital financing.

How Do I Start an NCA?

The good news is that you have options.

There are two (2) ways a local government could start an NCA: (1) by the local government itself as the “developer” to support long-term community capital financing; or (2) to support a specific project via a public-private partnership between a private “developer” and the local government. While the developer entity must own or control land to be included in the NCA district (RC 394.01), the developer can be a private entity, a municipality, a county, select townships, or even a port authority that owns or controls land—each of which must consent to inclusion of their property in the NCA district.

Creation of the NCA is traditionally initiated by the filing of a petition by a developer with the relevant City Council, Board of Township Trustees, or Board of County Commissioners as the appropriate “organizational board of commissioners” (RC 394.03). The appropriate organizational board of commissioners then reviews the petition for sufficiency, sets the time and place for a public hearing to occur, and later considers legislation to establish and define the boundaries of the NCA.

Over time, local governments may seek to expand the boundaries of the NCA. The process for adding property to the NCA district is similar to the initial creation process and begins when property owners voluntarily request for their property to be added to the NCA district. An application, or other voluntary consent, to add property must be filed with the organizational board of commissioners with which the original petition was filed (RC 349.03), and the organizational board of commissioners processes the addition in the same manner as the original petition.

Who Controls the NCA?

Again, you have options.

The NCA is frequently governed by a seven (7) member Board of Directors. This Board of Directors consists of three (3) members representing the developer, three (3) members representing the organizational board of commissioners, and one (1) member representing the local government (RC 349.04). The exact composition of the Board of Directors depends, however, upon how the NCA was started in the first place (hence the options).

For example, if the local government itself were to petition to start the NCA, it could appoint all seven (7) members of the Board of Directors—cementing local government control over the entity.

Alternatively, if the local government were to establish the NCA in public-private partnership with a private developer, the local government could appoint four (4) members while the private developer would retain three (3) members.

While state law requires members of a Board of Directors to be elected in the future as certain population thresholds established by the original petition process are met, state law also allows a local government to adopt an alternative method for the selection of successor members of the Board of Directors to further cement local government control over the entity (RC 349.04(C)).

How Does This Work [The Basic Course]?

The Ohio General Assembly has endowed NCAs with a large array of express economic development powers that provide local government with a flexible economic development tool.

After property owners have voluntarily requested or consented to the addition of their property to the NCA:

- The Board of the NCA may levy “community development charges” on property in the NCA district. Such “charges” may take many forms, including property-tax-like millage charges based on assessed valuation of property, sales-tax-like charges based on the gross receipts of businesses, bed-tax-like charges on lodging receipts, and other uniform-fee and flat-fee arrangements tied to parking or other items—it’s flexible. Charge revenue can then be utilized to pay costs of specific community facilities or to support long-term capital financing in the community; and

- The Board of the NCA may issue revenue bonds to pay for the development of community facilities, which may be secured by the charges; and

- NCAs can also own and operate community facilities, including parks, cultural facilities, streets, sidewalks, water and sewer infrastructure, parking facilities, and other capital assets; and

- Importantly, the NCA has no effect on local school districts, joint vocational school districts, or other taxing jurisdictions; and

- Local governments may pair NCA with traditional financing tools like Community Reinvestment Area (CRA) and Tax Increment Financing (TIF) programs to create powerful solutions to construct workable capital stacks.

Are My Neighbors Using NCA?

Bricker Graydon LLP mapping as of 2024 says, yes, they are!

But uptake of the NCA program prior to 2025 was largely centralized in the greater Columbus and central Ohio region with uptake not yet taking place to the same degree in the remaining regions of the state.

- Mapping indicates that Delaware County is a hub for NCA activity. The Concord/Scioto Community Authority, Powell Community Infrastructure Finance Authority, and Berlin Meadows New Community Authority, for example, each implement millage-based community development charges on residential units within their districts. These charges support NCA-issued revenue bonds used to undertake necessary public infrastructure improvements including, among others, water distribution, sewers and sewage collection, electrical lines, streets, and drainage. These NCA districts continue to grow and provide housing for growing populations north of Columbus.

- But mapping also shows that the Dayton Arcade in Dayton, Ohio recently implemented an NCA. Once a thriving staple of downtown Dayton for almost 90 years, the Dayton Arcade was closed in the early 90s. For thirty years, efforts to renovate the Dayton Arcade were unsuccessful. Public infrastructure in the Dayton Arcade was then financed through a public-private-partnership between the City of Dayton, the Dayton-Montgomery County Port Authority, and private developers. An NCA was created to assist with funding a capital stack that could give new life to the Dayton Arcade. The Dayton Arcade NCA today implements an Area Charge (fee per commercial-use square foot with the district) and a Retail Charge (fee on gross receipts), portions of which are used to secure bonds issued by the Port Authority. The Dayton Arcade now houses space for many restaurants, hotel, art, and educational community assets.

Conclusion

NCAs are a powerful—but underutilized—economic development tool. The attorneys at Bricker Graydon LLP are available to answer any questions you may have about adding the NCA program to your community’s economic development toolkit.

For more information about NCAs, and other economic development tools, download Bricker Graydon’s Economic Development Toolkit at the following link: DevelopOhio Economic Incentives Toolkit.

Note: The image information is accurate as of 2024 and reflects the most current details available. Please note that an updated image will not be provided until after 2025.